by Ben Taylor

Mobile money has revolutionised financial services in East Africa, starting with M-Pesa in Kenya and spreading from there. All Tanzania’s major mobile phone networks offer similar services, through which users can send money at very low cost to anyone in the country using a standard mobile phone.

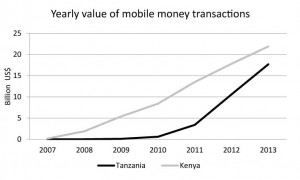

The global association of mobile phone network operators, GSMA, has recently published a report on mobile money in Tanzania, with a chart showing the total value of mobile money transactions since 2007:

Two points are worth highlighting here. First, though Kenya was undoubtedly the trendsetter, Tanzania is fast catching up, and looks set to overtake Kenya during 2014.

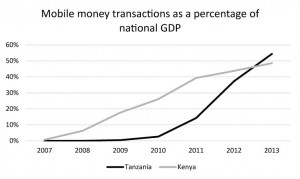

Second, take a look at the Y-axis label on the left. These figures are in billion US$. In other words, the total value of mobile money transactions in Tanzania in 2013 was US$17.7 billion. This is a huge amount – equivalent to over half (54%) of Tanzania’s GDP*. Which means in one sense Tanzania has already overtaken Kenya, where the value of mobile money transactions in 2013 was “only” 49% of GDP*:

This raises the question: is Tanzania the first country in the world where mobile money transactions are worth more than half the country’s GDP? Quite possibly it is.

* GDP Estimates are from IMF (2013): Tanzania US$32.5bn, Kenya US$45bn

Pingback: Will Mobile Money replace Traditional banking ? – Rhema Publishing and Media House