by Roger Nellist

LNG project land acquisition

The government has acted to address the two big hurdles delaying development of the liquefied natural gas (LNG) plant – namely, complex land acquisition procedures and the unclear legal framework (see TA 111).

On the first, government announced in May that it had set aside TSh 12 billion (about US$ 6 million) to buy land and compensate 450 people in Lindi where the LNG terminal is to be built. The plant, which will process the large volumes of gas discovered in recent years offshore southern Tanzania, may cost the developers US$ 30 billion and is unlikely to start operating until the early 2020s.

The development consortium comprises the licensees that discovered the gas (BG Group, Statoil, Exxon Mobil and Ophir Energy). Reuters reported the consortium will make a final investment decision next year.

So far, more than 53 trillion cubic feet of gas has been discovered and analysts believe that Tanzania (along with Mozambique) is now in a race with Russia, Australia, the USA and Canada to satisfy the gap in global gas supply expected by around 2020. Reuters also reported that Royal Dutch Shell agreed in April to buy the BG Group for US$ 70 billion in the first large oil industry merger in more than a decade, thereby giving the Anglo-Dutch oil giant access to BG’s Tanzanian projects.

Petroleum Bills passed amid controversy

Amid much controversy the government has also addressed the second big hurdle, ensuring in early July in the last session of Parliament the passage of three petroleum sector Bills: Petroleum Act 2015, Oil and Gas Revenue Management Act 2015, and Tanzania Extractive Industries (Transparency and Accountability) Act 2015.

These Acts were tabled, debated and passed under fast-track process known as a certificate of urgency, and in the absence of most Opposition MPs who, along with a group of about 60 Civil Society Organisations, pointed to alleged weaknesses in their content and flaws in the Parliamentary process and called for the Bills to be shelved pending further stakeholder discussions.

According to The Citizen (6 July), there was continuous uproar in the National Assembly for three consecutive days as Opposition lawmakers repeatedly tried to block Energy and Minerals Minister George Simbachawene from tabling the Bills following the government’s insistence that MPs should debate them. The Speaker suspended the first session and then barred more than 40 Opposition MPs from attending – a ban the Opposition contended was a deliberate move to ensure the “controversial” Bills were passed without any meaningful debate.

Minister Simbachawene said the Bills were sent to the House under a certificate of urgency because of their importance to the nation. The new laws were needed so government could negotiate good exploration and gas development contracts with investors. “We want this Parliament to debate the laws because they have been trained well enough on oil and gas issues … we even took them for learning tours to various countries such as Norway, China and Trinidad and Tobago”. He said deferring the Bills to the November Parliament would cause further costly delays to Tanzania and fresh training would be required for the new legislators; moreover, preparations for the three Bills had started in 2010 and stakeholders were involved and their views considered at several stages.

Among other things, the Petroleum Act 2015 establishes a Petroleum Upstream Regulatory Authority and an Oil and Gas Advisory Bureau (to advise the Cabinet on strategic matters). The Act also transforms the Tanzania Petroleum Development Corporation into the National Oil Company, with the mandate to manage the country’s commercial interest in petroleum operations as well as downstream natural gas activities.

It seeks to ensure that the gas industry benefits all Tanzanians including through the sourcing of Tanzanian goods and services, the training and employment of Tanzanians, and technology transfer. It repeals the previous petroleum laws, including the Petroleum (Exploration and Production) Act 1980 under which all exploration and development contracts and operations have been conducted for more than three decades but which did not fully address gas issues.

Renewable Energy

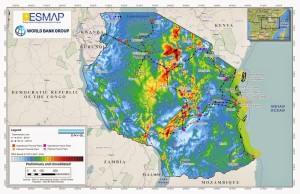

Tanzania’s plans for generating electricity from renewable energy resources should complement the country’s existing commercial energy supplies of hydropower and gas. In May, TANESCO announced preliminary results from the World Bank’s renewable energy resource mapping project, using global datasets and satellite analysis, indicating that Tanzania has immense solar and wind potential. The country’s resources suitable for solar power generation are considered to be equivalent to those of Spain whilst Tanzania’s potential for high wind power covers more than 10% of the country (an area the size of Malawi). One key finding is that certain areas of Tanzania with high solar irradiation also have high wind speeds at night, raising the possibility of round-the-clock power generation.

These initial findings will be validated over the next two years by placing 30 ground-based solar and wind measuring stations around the country, as part of a long-term partnership between the World Bank and TANESCO to modernize Tanzania’s power sector.

Africa Progress Panel report

A report (Seizing Africa’s Energy and Climate Opportunities 2015) by Kofi Annan’s Africa Progress Panel says 621 million people in Sub-Saharan Africa lack access to electricity. Energy bottlenecks and power shortages cost the region two to four per cent of GDP annually. Yet, driven by economic growth, demographic change and urbanisation, African energy demand is surging – widening further the energy gap between Africa and the rest of the world. Annan’s report says it would take the average Tanzanian eight years to use as much electricity as an average American consumes in a month!

Mining: Coal and Iron Ore

The Minister for Trade and Industry, Dr Kigoda, announced to Parliament in May the start of development of two related mega industrial-mineral projects – the Mchuchuma coal and Liganga iron ore projects in Iringa. They will establish an iron industry with an annual production capacity of one million tonnes (making Tanzania the third largest iron producer in Africa). Mchuchuma mine has more than 500 million tons of coal deposits, enough to produce 600 megawatts (MW) of electricity for more than a century. The coal-fired electricity plant will generate 250 MW for the iron industry and 350MW for the national grid.

Minister Kigoda said the two projects will create 32,000 jobs and generate about Tshs 3.13 trillion (US$1.5 billion) annually. They will be the largest single industrial investment in Tanzania since Independence.

The projects are being implemented by Tanzania China International Mineral Resources Ltd, a joint venture between Tanzania’s NDC (20%) and a Chinese firm (80%). According to Press reports these mega projects will cost up to US$3 billion to develop.