by Valerie Leach

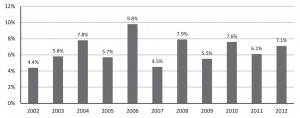

The economy continues to grow at an encouraging rate, recovering quite well from the downturns in 2007 and 2009. Gold and diamond production rose sharply in the first quarter of 2012 compared to the same period in 2011; and because of much better rainfall, the rate of growth in agriculture has improved.

GDP, First Quarter, 2012. Source: National Bureau of Statistics, Press Release, Summary Report of Quarterly Gross Domestic Product, First Quarter (January–March) 2012, www.nbs.go.tz

Consumer price inflation, while still high, continues to fall from its peak of 19.8% in December 2011 to 17.4% in June 2012. The increase in prices of food and energy remains at over 20% annually, though the rate of increase has slowed in recent months. The IMF has commended the government’s tightened monetary policy for 2012/13, aimed at supporting disinflation towards a single-digit inflation target. (www.nbs.go.tz and www.imf.org)

Trade

The balance of trade has worsened in the year to June 2012 compared with the previous year. The increase in the value of exports, led by increases in the volume and value of minerals exports, was offset by an increase in the value of imports, largely driven by a rise in oil prices, coupled with an increased demand for oil for thermal power generation. There was also a substantial increase in imports of machinery and equipment for gas and oil exploration. (Bank of Tanzania, Monthly Economic Bulletin, July 2012, www.bot-tz.org)

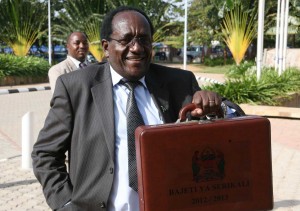

Government Budget 2012/13 and Long-Term Perspective Plan

This time of year is budget time in East Africa, and the Tanzanian government budget was presented to the Bunge in mid-June. It proposed a budget of TShs. 15.1trillion, TShs. 3.2 billion of which is expected to be received as grants and concessional loans for development (TShs. 842 million in general support loans and grants, and TShs. 2.3 trillion in project grants and loans).

Among the tax measures to support local industries and create jobs were the abolition of VAT for textile mills, increased tax on imported edible oil and a review of the skills development levy. The budget also included the usual increases in excise duty on drinks and tobacco, as well as an increase in excise duty on mobile phone calls.

Some tax exemptions are to be removed, with a 10% VAT introduced for those previously exempt. Included in the abolition of tax exemptions was tax relief for non-governmental organisations, except that equipment donated to orphanages and schools remain exempt. (Daily News 14 June and Minister of Finance, June 2012).

In the course of the budget debate, Kondoa MP Juma Nkamia reported that 27,000 tonnes of edible sunflower oil was stalled in godowns in the district because of lack of reliable market. (Daily News 28 June).The budget includes an allocation of TShs. 1 trillion in 2012/13 to decongest roads in Dar es Salaam. (Daily News 6 July).

Thirty per cent of the total budget is intended for development projects (TShs. 4.5 trillion). The development plan puts priority on infrastructural improvements, including the Kurasini logistical and trade hub, rehabilitation of the central railway line and construction of a natural gas pipeline between Mtwara and Dar es Salaam, which will be funded through a loan from Exim Bank of China. Funds have also been allocated for power generation plants at Kinyerezi and for upgrading the north-west grid from Iringa to Shinyanga and from Makambako to Songea. (budget speech of the Minister of Finance www.mof. go.tz)

Minister Wasira, Minister of State in the President’s Office, said that large investment in gas exploration in Mtwara and other coastal areas meant that foreign direct investment increased substantially in 2011 to $854 million, from $434 million in 2010. (Daily News 15 June).

The main opposition CHADEMA Party proposed an alternative budget which put more emphasis on development funding and a reduction in recurrent spending, particularly on allowances, seminars, foreign travel and procurement of large luxury vehicles for government officials. (Daily News).

The Minister of Finance reported improvements in financial management, citing the latest report of the Controller and Auditor General for the year 2010/11, in which unqualified audit reports for ministries, independent departments and regional secretariats improved from 71% to 85% in 2009/10. Unqualified reports in local authorities increased from 49% to 54%.

One important element of the budget of the Prime Minister’s Office was an allocation of TShs. 73.2 billion for the purchase of books for all primary schools, reducing the ratio of books to pupils from 1:10 to 1:2/3. This is 75% of the money returned from the radar deal. The remainder will be used to purchase 400,000 desks. The World Bank will fund access to telecommunications in areas not now served.

Long-Term Development Plan

A “Roadmap to a Middle Income Country” has been published by the Planning Commission. This long-term perspective plan (to 2025/26) is intended to set specific direction to meet the objectives of Tanzania’s Vision 2025 (published in 1999). The long-term plan provides the link between the Vision and the country’s medium- and short-term development plans. A series of three five-year plans aim to unleash growth potential, nurture an industrial economy and promote competitive export growth.

The plan’s targets for 2015 are to raise GDP growth to 8% and agricultural growth to 6%, reduce inflation to 4-5% and reduce the poverty rate to 19.3%, a particularly ambitious target since the latest data indicated that the population living under the poverty line was 33.6% in 2007.

By 2025, the plan projects that the percentage of people employed in agriculture will have fallen to 41%, compared to the current 75%. Similarly ambitious targets are set for export growth, from 28% of GDP in 2010 to 40% in 2025. Sharp reductions in pupil:teacher ratios are planned both at primary and secondary levels. (Tanzania Long-Term Perspective Plan, Roadmap to a Middle Income Country, President’s Office, Planning Commission, June 2012 www.tanzania.go.tz/pdf/mpango%20Elekezi.pdf)