by Dr Hildebrand Shayo

Vice President Philip Mpango and Finance & Planning Minister Mwigulu Nchemba launching the National Development Vision 2050.

Tanzania’s National Vision 2050: lessons to learn from China?

Dr Samia Suluhu Hassan, the president of the United Republic of Tanzania recently endorsed the process of soliciting public input for the National Development Vision 2050 (NDV). Among the eight directives she issued was a need to adhere to a strong emphasis on national integrity.

To create prosperity for all, the NDV 2050 places a strong emphasis on an inclusive economy that aims to reduce poverty, create jobs, and increase exports outside the nation to earn foreign currency. The endorsement took place in the nation’s capital, Dodoma, in front of international partners and development agencies who attended the launching of the process of preparing the new vision, showcasing their commitment to supporting Tanzania’s development journey.

For a trip like this to bear fruit, we must learn from our peers. There are lessons to be learned from China, for example, which has a remarkable record at eradicating poverty with a well-coordinated and capable, focused government. These factors made the country’s strategy for economic growth possible, as well as the carefully calibrated policies and programmes that produce the long-term gains that the rest of the world is currently experiencing.

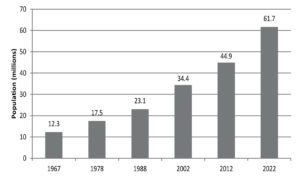

Published Chinese data shows that from 1970 to 2017, the percentage of Chinese citizens living in extreme poverty fell from approximately 90% to 88% in 1981, 10.2% by 2012, 3.1% by 2017, and approximately 30.46 million at that time. It was stated in 2022 that only 0.7% of people were considered to be living below the poverty line. How China did this is a potentially useful lesson for Tanzania in its planning for NDV 2050.

Undeniably, China’s efforts to reduce poverty have depended on a series of dedicated and determined leaders, starting with Chairman Mao, followed by Deng Xiaoping (who implemented the National Economic Development Programme), and, more recently, President Xi Jinping, who has made the fight against poverty the centrepiece of his administration.

A large portion of the imperial economy was based on agriculture and agrarianism, which meant that generations of Chinese people had historically lived in poverty for tens of decades under the various Dynasties. But starting in 1949, the Chinese Communist Party made a significant effort to lessen extreme poverty and inequality, which resulted in land and economic reforms.

This measure was followed by investment in rural healthcare and education facilities, as well as farm irrigation systems. Throughout, the CCP was the catalyst for the nation’s efforts to reduce poverty.

The Chinese government’s subsequent initiatives to reduce poverty, a good lesson to Tanzania were based on two main factors. One, the economy must be transformed to create new opportunities and raise income levels; Two, policies and programmes to reduce poverty must target demographics that lack access to opportunities due to their geographic location.

Based on this, Tanzania could in its NDV 2050 adopt the four main strategies that China used to reduce poverty: improving urbanisation, which will encourage the development of industries and income potential; increasing agricultural productivity, which will help raise household and farmer incomes; continuing industrialization, which will result in a record number of well-paying jobs and an increase in foreign investment; and significant investments in infrastructure, particularly roads, which will help to improved access to markets and distribution networks.

Currently, one of the main tenets of President Xi Jinping’s governance policies is poverty reduction and this new phase of poverty alleviation in 2012 began when the sitting president took office, solidifying the record of at least seven hundred million people who had been helped by the CCP to escape poverty.

The government needed to identify the impoverished groups and determine the underlying causes of their poverty to implement relief policies and decide who could carry out the programmes at the central, municipal, prefectural, and county levels. This approach could give Tanzania a good start as it establishes the foundation for NDV 2050.

The Xi Jinping administration outlined 5 courses to alleviate poverty. These included: the economy’s continued growth to keep growth job availability or the developmental approach; the relocation of people from extremely impoverished areas to areas where they can find better livelihoods; the creation of environmentally friendly employment opportunities; the provision of quality education as a means of bridging intergenerational poverty; and the provision of social security for those unable to work, including insurance and medical care. All these offer potential as ingredients for Tanzania’s NDV 2050.

A good lesson for Tanzania, as it starts working on NDV 2050, is to know that a fundamental element in the accomplishment of China’s unparalleled efforts to reduce poverty was the presence of sound governance, resulting from devoted leadership, which made it possible for the economic growth plan and the well-targeted policies and initiatives to produce long-term benefits.

China’s success in reducing poverty can be rationalised as a growth story, illustrating how steady and quick economic expansion resulted in changes to the productive base of society, which were then linked to the strengthening of market incentives.

China’s rapid economic and social growth was facilitated by its long-term development plan, strength, and ruthless prioritisation of government goals. These factors attracted investment and provided incentives for growth in important sectors like infrastructure, agriculture, health, education, and technology, among others. The Development Vision 2025–2050 will promote stability, draw investment, and guarantee equitable growth, benefiting all Tanzanians. It will do this by acquiring from peers, especially from China and the United Kingdom.