Tanzanian Affairs is a magazine with news and current affairs issued by the Britain-Tanzania Society. It is published three times a year. The views expressed or reported are those of the person concerned and do not necessarily represent the views of the Britain-Tanzania Society. All the information is copyright – please refer here for more details.

TA ISSUE 142

General Elections 2025

Tourism Boom

Reviews

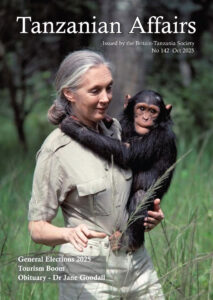

Obituary – Dr Jane Goodall

A pdf of the issue can be downloaded here

FROM THE EDITOR

by Ben Taylor

Dear reader,

Welcome to the latest issue of Tanzanian Affairs.

As you may have noticed, we have taken a slightly different approach to this issue. With the sad news that the editor of the Britain-Tanzania Society newsletter, Jennifer Sharp, passed away earlier this year, the BTS committee has decided, going forward, to incorporate some of what would previously have been included in the newsletter into Tanzanian Affairs. This is starting small, with two pages of news from BTS’s charitable arm, Tanzania Development Trust (TDT). More will follow in future issues.

Of course, you will continue to find much the same type of news that Tanzanian Affairs has always covered. In this issue, this includes extensive coverage of the imminent general elections in Tanzania, as well as articles on Tanzania’s expanding rail and road networks, progress (or lack of) with natural gas processing investment negotiations, the rising importance of tourism to Tanzania’s economy, the challenges around regulation of ride-sharing services such as Uber, and some sporting success.

We also have reviews of some fascinating new books. In Salama binti Rubeya: Memories from the Swahili littoral, Dr Ida Hadjivayanis and Salha Hamdani share the true life-story of their mother / grandmother: casting light on the social history of the Swahili coast from an important but often-neglected perspective. And there are two significant photographic books on Tanzania’s history – the first on the life of Julius Nyerere and the second on the history of the Union.

We have also made a late change in response to the unfortunate news of the passing of Jane Goodall, including reflections from the BTS chair, Paul Harrison.

If you have ideas, stories, or resources you’d like to see featured in future issues, please don’t hesitate to reach out.

Warm regards,

Ben Taylor (Editor)

GENERAL ELECTIONS

by Ben Taylor

Presidential election – the three main party leaders: President Samia (CCM), Luhanga Mpina (ACT Wazelendo) and Tundu Lissu (Chadema)

General elections in Tanzania: October 29, 2025

Tanzania’s forthcoming general elections represent a significant moment in the nation’s democratic trajectory. These polls will determine the presidency, 393 seats in the National Assembly, and local government positions across the mainland and the semi-autonomous islands of Zanzibar, for the next five years.

With over 30 million registered voters, the elections occur against a backdrop of some political re-opening under President Samia Suluhu Hassan, who assumed office in 2021 following the untimely death of President John Magufuli. However, concerns remain over restrictions on critics, opposition participation and institutional disputes, raising questions about the credibility of the broader democratic rebuilding process.

In particular, it looks likely that President Hassan, seeking re-election as the candidate of the ruling party, CCM, will face no meaningful opposition candidate. Chadema’s leader, Tundu Lissu, will miss the election, as he is in prison on charges of treason, and his party has refused to legitimise the elections by putting forward candidates. In any case, the electoral commission has blocked them from participating. The Alliance for Change and Transparency (ACT Wazalendo), the only other party with significant support, has had its campaign interrupted by the electoral commission’s decision to block their proposed Presidential candidate, Luhaga Mpina, from standing – a move on which the High Court has (at the time of writing) not yet reached a final decision.

Voter turnout, which has historically fluctuated between 50%-70%, may be low, due to apathy or bans / boycotts. Meanwhile, a historic surge in female candidates – over 40% of parliamentary aspirants – highlights evolving gender dynamics.

The legacy of 2020

The 2020 general elections inevitably form part of the context for this year’s polls. These were marked by widespread allegations of fraud and violence that eroded trust in Tanzania’s electoral institutions. Incumbent President John Magufuli of CCM secured a landslide victory with 84.4% of the presidential vote, while his party claimed 365 of 393 parliamentary seats. Official turnout was reported at 50.7%.

Opposition parties, led by Chadema, rejected the results, alleging ballot irregularities, intimidation, and the disqualification of many candidates on questionable technical grounds. Chadema’s presidential candidate, Tundu Lissu, garnered just 13%, but rejected the outcome, fleeing to exile amid arrests of party officials.

The polls unfolded under Magufuli’s tightened political environment, including restrictions on independent media and political rallies, which stifled opposition campaigns. International observers, such as the European Union, were absent after being denied visas, leaving only limited Commonwealth and African Union missions that faced restrictions.

Critics argue these elections exemplified “electoral authoritarianism,” where formal democratic processes mask one-party rule. Hassan’s ascension promised reforms, but the 2020 legacy – including distrust in election authorities – persists, fuelling opposition demands for constitutional reforms and true independence for the electoral commission.

Authoritarian drift?

Tanzania heads to the polls amid what some analysts have described as a new narrowing of political space under President Hassan. Once hailed for tentative reforms post-John Magufuli’s death in 2021, this democratic re-opening been increasingly called into question. Freedom House downgraded Tanzania from “Partly Free” to “Not Free” in its 2025 report, citing manipulated voter registrations and broader erosion of electoral integrity. Similarly, the International Institute for Democracy and Electoral Assistance (IDEA), says the ruling party’s approach has transformed what could have been a competitive democratic exercise into one of unchallenged CCM dominance.

UN human rights experts in June 2025 expressed concern over a “pattern of enforced disappearance and torture” against political opponents, urging the government to halt such practices. Amnesty International reports that four government critics have been forcibly disappeared and one killed in 2024-2025, attributing these to efforts to curb opposition ahead of the elections.

More recently, the Tanzania Communications Regulatory Authority (TCRA) suspended the license of Jamii Forums, a major social media news platform on September 6, and has directed police to “patrol the internet” for election-related content since August. Human Rights Watch (HRW) reports broader clampdowns, including bans and/or measures to block access to online platforms like WhatsApp and Twitter / X.

In response to such criticisms, President Hassan on September 17, 2025, urged unity and highlighted the preparedness of security forces to maintain order during the elections: “Peace and stability in our country are more important than anything else. Elections are not a war but a democratic process. Our defence and security organs, both in Mainland Tanzania and Zanzibar, are fully prepared to protect this peace. Citizens must remain calm and united.” Earlier, in March, she said that “we have sworn to protect the rights and dignity of every Tanzanian, and we will not hesitate to act against anyone who exploits these freedoms to incite discord.”

The Tanzania Police Force, in an official statement released on June 18, in response to reports of abductions and disappearances, denied state involvement and attributed many cases to unrelated factors: “In the cases reported at police stations and thoroughly investigated – where the missing individuals were later found either alive or deceased – evidence in some instances has revealed causes such as self-staged abductions, jealousy in romantic relationships, superstitious beliefs, property disputes, acts of revenge, travel to foreign countries to learn extremist ideologies, and fleeing from justice after committing crimes.”

The statement further defended the police’s role: “The government, through the Police Force, has the responsibility to protect people’s lives and property and not otherwise. Furthermore, all reported incidents involving the disappearance of various individuals are still under investigation until the truth is established about what happened to our fellow Tanzanians.”

Beyond Tanzania, the SADC Electoral Commissions Forum (ECFSADC), which deployed a pre-election assessment mission to Tanzania from August 12-16, reported “no major issues flagged” in preparations for the elections. They recommended enhancements like increased voter education, framing the process as stable rather than flawed. The AU has offered similarly measured endorsement through a June 2025 preelection assessment that “praised logistical preparations” while urging civic education and rights safeguards, avoiding outright criticism and focusing on constructive engagement.

Chadema’s ban and boycott stance

Chadema, Tanzania’s largest opposition party, will watch this year’s election from the sidelines, facing a controversial ban and/or their own boycott. In April 2025, the (so-named) Independent National Electoral Commission (INEC) disqualified Chadema from presidential and parliamentary contests, after party officials refused to sign the 2025 Election Code of Ethics. Chadema had said it would not sign the code until the government undertook electoral reforms. This followed the arrest of Tundu Lissu, Chadema’s recently-returned leader, on charges that critics have described as politically motivated, and raids on party offices. Chadema, which polled strongly in 2020 in urban areas, also now faces exclusion from all by-elections until 2030.

Rather than a full boycott, Chadema has framed its response as a “No Reforms, No Election” campaign. They call for a truly independent electoral commission, revival of the stalled constitution writing process abandoned in 2013, and legal changes to allow independent presidential candidates and judicial review of presidential election results.

Party officials insist this is not disengagement but a fight for fairness. Nevertheless, the ban / boycott / protest effectively undermines the opposition challenge at the polls, handing CCM a much clearer path.

Zanzibar

Zanzibar’s elections are likely to be more competitive. As a semi-autonomous region, Zanzibar elects its own President, 85-member House of Representatives, and local councils under the Zanzibar Electoral Commission (ZEC), as well as casting votes for Tanzania’s president and MPs in Tanzania’s National Assembly. CCM’s Hussein Mwinyi seeks re-election as President of Zanzibar.

Debates over the relationship between Zanzibar and the Union simmer, with many islanders supporting calls for independence referendums, or at least for constitutional reforms to give Zanzibar increased autonomy.

The opposition landscape on the isles is also somewhat confused. The decline of CUF after 2015 paved the way for ACT Wazalendo as a rising force on the islands. This left-leaning party blends social justice with anti-corruption rhetoric. Nevertheless, lingering elements of CUF threaten to weaken ACT Wazalendo’s vote share and their potential post-election coalition role.

ACT on the national level

Nationwide, ACT Wazalendo faces some similar challenges to Chadema. Their presidential candidate for Tanzania, Luhaga Mpina, was initially banned by INEC from standing. The ban stems from an objection by Attorney General Hamza Said Johari, who argued that Mpina lacks the necessary qualifications based on a prior ruling by the Registrar of Political Parties, citing irregularities in ACT Wazalendo’s internal nomination processes.

Mpina was MP for Kisesa constituency, representing CCM, and served for three years as Minister of Livestock and Fisheries under President Magufuli. In August 2025 he left CCM and joined ACT Wazalendo.

The High Court overturned this decision on appeal, only for INEC to reinstate the ban. ACT Wazalendo immediately challenged the second ban through multiple legal avenues, culminating in a constitutional petition filed on September 19. At the time of writing, with less than one month remaining before the election, the court ruling is pending, thought to be imminent.

Election Monitoring Initiatives

The EU has deployed a 100-member Election Observation Mission (EOM), following Tanzania’s invitation. The African Union conducted a June pre-election assessment, praising logistics but urging civic education. SADC’s Electoral Commissions Forum visited in August.

Other Significant Developments

Beyond core issues, the 2025 elections spotlight women’s empowerment, with over 200 female parliamentary candidates – a 50% jump – driven in part by quotas as well as by Hassan’s trailblazing example.

MANIFESTOS

by Ben Taylor

What do the Manifestos say?

As Tanzania gears up for the elections, the ruling Chama Cha Mapinduzi (CCM) and opposition Alliance for Change and Transparency (ACT Wazalendo) have unveiled their manifestos outlining their goals for 2025–2030. CCM’s document, launched on May 31, 2025, emphasises continuity and alignment with the ambitious Tanzania Development Vision 2050, targeting a $1 trillion economy. ACT Wazalendo’s manifesto, released August 11, 2025, adopts a bolder, reformist tone, critiquing “elite capture” and pledging radical shifts toward equity and resource nationalism. Both prioritise economic transformation, job creation, and social welfare but differ in scope and ideology: CCM’s business-friendly growth-focused approach versus ACT’s interventionist, people-centered reforms.

CCM Manifesto: Building on Stability for Inclusive Growth

CCM’s manifesto for 2025–2030 emphasizes continuation and acceleration of economic transformation, infrastructure development, social services, and stronger institutions. Some of the highlights include:

• Economic growth & industrial transformation: A target to modernize the economy by adding value to local resources rather than exporting raw materials. Industry sector growth target of 9% annually by 2030.

• Agriculture, livestock & irrigation: Aim to improve agricultural production significantly: subsidies on inputs, better seeds, more modern farming, increased irrigation, increase grazing lands (livestock) and fishing sector improvements.

• Employment & revenue: Target to generate 8.5 million jobs in both formal and informal sectors. Strengthening revenue collection, aiming revenue-to-GDP ratio of 15.6%.

• Infrastructure, trade & local industrial zones: Greater investment in roads, ports, railways (including a new/revamped line connecting Tanga, Arusha and Musoma on Lake Victoria), and logistics to boost trade and connectivity. Establishing district-level industrial zones to support localised industrialisation.

• Social sectors & human development: Free education from primary through secondary; more vocational training.

• Housing: formalising housing, surveying, granting ownership, improving access to decent housing.

• Constitutional reform & governance: CCM pledges to revive the constitution review process. Increased attention to inclusivity, participation of civil society, youth, community leaders in consultations.

• Debt, macroeconomic stability: Ensuring national debt remains sustainable and that external and domestic borrowing is used for productive projects.

ACT Wazalendo

ACT Wazalendo positions itself more strongly on redistribution, governance reforms, social justice, and asserting community rights over land and natural resources. Key features include:

• Land, natural resources & resource nationalism: The party describes land as “life” and calls for bold reforms in how land is managed, reversing “arbitrary privatisations,” returning lands improperly converted (ie. to protected areas), allocating idle land to youth/vulnerable groups. They also propose greater transparency in extractive industries; ensuring citizens benefit from mining, oil, gas, forests.

• Social services, equality, human development: Universal health insurance; free education up to university level; improved access to clean water and electricity; stronger social protection, especially for informal sector and rural communities.

• Infrastructure & connectivity: Major infrastructure plans include a Southern Standard Gauge Railway (linking Lindi, Mtwara, Songea/ Ruvuma and mining projects in Njombe), rehabilitation of regional rail lines, strategic roads, and improving ports (Mtwara, Tanga, Bagamoyo, Kigoma). Rural electrification and last-mile access to water, transport and communications networks.

• Governance, justice & constitution: Police and judicial reforms, repealing repressive laws, restarting constitutional review within six months for power limits and an independent electoral body, and a three-tier Union structure for Mainland-Zanzibar equity.

• Inclusive economy & empowerment of ordinary citizens: Reducing elite dominance in national resources; putting citizens at centre of economic planning; formalisation of informal businesses and support for small traders; fair markets and prices for farmers, herders, fishermen; removal of unfair levies etc.

• Environment, climate, tourism: Balancing development with environmental protection; more community-based conservation, protecting coastal areas, mangroves, reefs; implementing green growth; reform in tourism to ensure more of the value stays in Tanzania.

What about Chadema?

Given that Chadema is boycotting the election / has been deemed ineligible, they have not published a manifesto. However, for completeness, their stated priorities include:

• “No Reforms, No Election” is Chadema’s central campaign slogan, calling for “fundamental” reforms in the electoral system. This includes a new constitution or significant constitutional reforms; reforms of electoral bodies and processes, to ensure elections are free, fair, and credible; equal opportunity for all political parties in elections; and fairness in how the rules are applied.

In conclusion

Many of the promises (from both manifestos) are ambitious in scale. Implementation will depend heavily on financing, institutional capacity, corruption control, legal frameworks, and external economic factors (e.g. global markets, climate change). Both align with Vision 2050’s $1 trillion goal but diverge on means: CCM via private partnerships, ACT through state assertiveness.

ACT’s proposals around land restitution and resource sharing may face pushback from existing stakeholders (private investors, communities that benefited under the old allocations, foreign investors). For CCM, sustaining high budget commitments (on infrastructure, jobs, agriculture subsidies) without increasing unsustainable debt or wasting resources will be a challenge.

ECONOMICS

by Dr Hildebrand Shayo

Tanzania’s standing in the context of evolving global geopolitics Recently, an article in an English-language newspaper circulated in Tanzania suggested that Tanzania has been sleepwalking into global irrelevance. The author stated, among other things, that the relocation of UN offices to Nairobi, Kenya, serves as a significant indicator of Tanzania’s declining prominence, given the previous experience from Arusha was a testimony that Tanzania was ready to accommodate such offices.

For Tanzanians, an explanation provided by Susan Ngongi Namondo, the UN Resident Representative in Tanzania, along with the reasons for choosing Nairobi, implied that the author should have reached a different conclusion about Tanzania’s position.

Between 2022 and 2024, Tanzania experienced a significant increase in foreign investment inflows, mainly due to improved policy stability, regulatory reforms, and strategic infrastructure development. Sectors such as mining, energy, agribusiness, and manufacturing, have attracted heightened attention from international investors, bolstered by governmental initiatives aimed at refining investment processes via entities such as the Tanzania Investment Centre (TIC). This positive trajectory has fostered job creation, facilitated technology transfer, and enhanced export diversification – essential components in fortifying Tanzania’s economic foundation.

Under the current leadership, these efforts have strengthened the nation’s economic resilience within the region. These investments align well with the nation’s primary goals outlined in Development Vision 2050 (DV2050), which aims to develop into an upper-middleincome and globally competitive economy by promoting sustainable industrialisation and inclusive growth.

Another area mentioned was human capital and how Tanzania has neglected education. Based on the assessment of the budget approved by the National Assembly from 2022 to 2024, Tanzania has made notable advancements in enhancing human capital by augmenting government investment in education, elevating productivity in both public and private sectors.

Prominent initiatives have encompassed the broadening of access to technical and vocational education, the elevation of teacher training standards, and the incorporation of information and communication technology within educational institutions. The initiatives in place are now yielding tangible results, as a growing workforce gains proficiency in relevant, job-ready skills.

Further, Tanzania made notable advancements in logistics efficiency between 2022 and 2024 by implementing strategic investments in its transport infrastructure. Recent advancements have positioned Tanzania as a key logistics hub in the region, enhancing its trade competitiveness and strengthening economic ties with neighbouring nations.

The procurement of a new fleet for Air Tanzania has significantly improved domestic and regional air connectivity. Implementation of the Standard Gauge Railway (SGR) has improved cargo transportation from Dar es Salaam Port to inland and landlocked nations, such as Rwanda, Uganda, and the DRC. At the same time, advances in port efficiency, such as digitized clearance systems and increased handling capacity, have reduced turnaround times and boosted throughput.

Those with insights and knowledge backed by data from government institutions such as BOT and NBS, and reviews conducted by the World Bank and IMF, can confirm how Tanzania is performing strongly on the regional and global stage, especially as Kiswahili continues to be a preferred UN language and enhances regional and international cooperation.

TOURISM & ENVIRONMENTAL CONSERVATION

by James L.Laizer

Tanzania tourism overtakes gold as top foreign exchange earner

Tanzania’s tourism sector has officially surpassed gold as the country’s leading foreign exchange earner, marking a historic milestone for the nation. Latest figures from the Bank of Tanzania and the Ministry of Natural Resources and Tourism show the industry generated $3.92 billion in the year ending May 2025, outpacing both gold and agriculture for the first time.

“This is a clear signal that tourism is no longer just a leisure sector, it is a strategic pillar for national development,” said Minister of Natural Resources and Tourism, Dr. Pindi Chana. “Our reforms, combined with Tanzania’s unique natural and cultural assets, have positioned the country as a top global destination.”

Tourism now contributes over 17% of Tanzania’s GDP and nearly 30% of Zanzibar’s economy, supporting more than 1.6 million jobs. Its resilience, particularly after the COVID-19 pandemic, has underscored its potential to reduce poverty and diversify income away from extractive industries like gold mining. Key reforms have helped unlock this growth. The Bank of Tanzania’s revision of foreign exchange regulations now allows tour operators to pay for services on behalf of international visitors and purchase specialized vehicles in foreign currency. Tanzania Association of Tour Operators (TATO) Chairperson, Mr. Mussa Makame, noted, “These exemptions remove significant operational bottlenecks and make Tanzanian tourism globally competitive.”

Tanzania’s natural assets remain the sector’s greatest draw. Mount Kilimanjaro, the Serengeti, and Zanzibar’s beaches continue to attract global attention. The country swept the 2024 World Travel Awards, winning Africa’s Leading Destination and World’s Leading Safari Destination. Private sector collaboration has been pivotal. TATO has championed sustainable tourism, promoted underexplored circuits, and implemented guidelines to protect the Mara River migration crossings. “Responsible tourism is essential,” said Makame. “We must balance growth with conservation to preserve Tanzania’s heritage for future generations.”

However, challenges remain, including infrastructure gaps, climate change, and over-tourism in key circuits. Yet with tourism revenues now exceeding gold, the country is better positioned to sustain reforms, strengthen partnerships, and deliver long-term economic and social benefits.

Zanzibar records historic tourism high

Zanzibar has reached a historic milestone, welcoming over 106,000 tourists in July 2025, the highest monthly figure ever recorded on the islands. This surge highlights Zanzibar’s growing reputation as a premier travel destination in the Indian Ocean, drawing visitors from Europe, the United States, and neighbouring African countries.

Improved flight connectivity, innovative travel packages, and the island’s unique blend of natural beauty, cultural heritage, and vibrant marine life have fuelled this boom. From the white-sand beaches of Nungwi and Kendwa to historic Stone Town and the fragrant spice farms, Zanzibar offers experiences that are both authentic and memorable.

The tourism boom is already stimulating the local economy. Hotels, resorts, restaurants, and tour operators report unprecedented demand, creating jobs and supporting small businesses. The Zanzibar Commission for Tourism notes that this surge aligns with government efforts to position the islands as a world-class destination while emphasizing sustainable practices. Authorities stress that growth must go hand in hand with environmental conservation, especially the protection of coastal ecosystems and historical sites.

The record-breaking numbers also reflect renewed confidence in Zanzibar’s tourism infrastructure, with improved facilities enhancing the visitor experience. Industry experts anticipate that momentum could continue in the coming months, reinforcing Zanzibar’s status as a top destination in East Africa.

For Zanzibaris, tourism is more than numbers, it represents livelihoods, community development, and resilience. Sustaining growth responsibly, investing in infrastructure, and conserving the islands’ unique natural and cultural assets will be key to maintaining Zanzibar’s success on the global tourism map.

Tanzania’s 2025/26 budget: what it means for climate action

Tanzania’s 2025/26 national budget, presented on June 12, 2025, by Finance Minister Dr. Mwigulu Nchemba, reflects a mix of ambition and challenges in tackling climate change. With a ceiling of TSh 56.5 trillion, the budget outlines how the government plans to support economic growth while strengthening resilience against floods, droughts, and other climate-related disasters. “Climate change is no longer a distant threat; it is affecting agriculture, health, energy, and livelihoods,” Dr. Nchemba emphasised. “Our budget must address these risks while supporting economic growth.” Yet, experts warn that allocations for climate adaptation, especially for vulnerable rural communities, remain insufficient.

Tanzania’s economy is highly climate-sensitive. Agriculture, livestock, fisheries, energy, transport, and health sectors all face rising risks from erratic rainfall and prolonged droughts. The natural resources, environment, and tourism sector received TSh 317.4 billion – well below the TSh 441.8 billion requested highlighting a continued reliance on external grants and loans.

The budget includes measures to promote cleaner energy. The government aims to expand Liquefied Natural Gas (LNG) for cooking, boost Compressed Natural Gas (CNG) in transport, and continue oil and gas development. Tax incentives on electric and gas-powered vehicles, VAT exemptions for cleaner fuels, and excise duties on coal and gas emissions are intended to encourage greener practices and reduce deforestation. Agriculture and water sectors received substantial allocations of TSh 1.93 trillion and TSh 898.1 billion respectively, focusing on irrigation, climate-resilient crops, and infrastructure projects such as the Simiyu Climate Resilience Project, supported by the Green Climate Fund and KfW.

However, gaps remain. Many initiatives focus more on mitigation and revenue generation than on strengthening resilience for those most exposed to climate shocks. Analysts stress the urgent need for domestic financing, through green bonds, private partnerships, and careful allocation of carbon revenues to complement international support.

In a world of shrinking aid and rising climate risks, Tanzania’s budget is both a step forward and a reminder: effective climate action must balance mitigation with adaptation, ensuring communities on the frontlines are not left behind.

TANZANIA DEVELOPMENT TRUST

by Sheila Farrell

Elidetha and friends who benefited from an Mboni ya Vijana project with TDT funding to provide a borehole in her village in Kigoma region.

A good year for TDT

Tanzania Development Trust, the development arm of the Britain Tanzania Society, has just completed another good year, although revenues at £243,000 were £50,000 below their 2023-24 peak due to a reduction in legacies and large “one-off” donations.

Just over half of our general income comes from individual donations, with BTS members providing around half of these. A further 10% comes from BTS members using TDT as a tax-efficient way of sending money to their own projects in Tanzania. Although we have diversified our sources of income in recent years, attracting more external grants and non-BTS donations, it is ultimately your generosity that determines the number of projects we are able to undertake each year. So please think about whether you might be able to donate a little bit more now, or remember us in your will.

TDT has completed some truly inspiring projects in 2024-25 in its core areas of clean water, girls’ education, and small income-generating activities, benefitting an estimated 110,000 people. Most of the projects are small (under £6,000) but provide the seed capital needed to help people to help themselves.

In the water sector, we have on-going programmes for the construction of shallow boreholes and spring protection works. These are great value for money. Costing around £1,500 each, they provide clean water to small villages of around 1,500 people who previously relied on dirty ponds or streams at risk of disappearing during the dry season. The public health benefits have been immediately apparent, and many of the schemes also reduce the time spent fetching water. Around half of our income was spent on clean water projects last year, allowing us to bring clean water to over 60 villages.

In education, we provided 13 schools with hostels, computer technology or help in growing their own food, as well as a boarding school for teenage mothers in Tabora. TDT is also closely involved with a vocational training centre and school for deaf children near Dodoma.

Small income generating projects help people to set up sustainable businesses that add value to local agricultural outputs, make use of local raw materials, or supply regular local demands for things like school uniforms. Pass-a-pig (or goat) schemes remained popular, and last year we became involved for the first time in a plastics recycling project offering commercial incentives for better waste management.

TDT is run entirely by volunteers, so 100% of the money we raise goes directly to projects in Tanzania. Our UK-based Project Officers are responsible for ensuring that all projects are properly vetted before any funding is approved and follow up on projects after they have been completed to check how effective they have been. However, our big success in recent years has been in building up a 17-strong team of Local Representatives who act as our eyes and ears on the ground. Local knowledge is the key to effective development assistance, and they have been invaluable in providing it. So a big Thank You to our Tanzanian volunteers.

If you would like to read TDT’s Annual Report in full, you can find it at https://www.bit.ly/TDTAR25

TRANSPORT

by Ben Taylor

Mwanza: John Pombe Magufuli Bridge

On 19 June 2025, President Samia Suluhu Hassan inaugurated the 3.2 km John Pombe Magufuli Bridge, spanning an inlet of Lake Victoria in Mwanza. This cable-stayed bridge, East Africa’s longest, connects Kigongo to Busisi, slashing travel time across the lake from 35-minute ferry rides to a five-minute drive.

Costing TSh 682 billion (approximately US$280m), the Chinese-funded project includes a 35km approach road, enhancing connectivity for over one million residents in Mwanza and Geita regions. It will support enhanced trade with Uganda, Rwanda, and Burundi by linking to key highways, potentially boosting agricultural and mineral exports. The bridge, with a 32m clearance for maritime traffic, supports 3,500 daily vehicles, easing congestion and cutting logistics costs by up to 20%.

President Samia hailed it as a “game-changer” for regional integration, projecting 5,000 direct and indirect jobs.

The bridge took approximately six years to construct. Construction began in 2019 following the signing of a contract in 2018 with a Chinese consortium led by the China Railway Major Bridge Engineering Group and China Railway No. 8 Engineering Group. It was originally envisaged to be completed in 2022, as outlined in early government announcements and contractor agreements, but delays due to logistical challenges, including land acquisition for the 35 km approach roads, and technical complexities extended the timeline by approximately three years.

SGR developments – and further promises

In July 2025, President Samia Suluhu Hassan launched electric freight services on the Standard Gauge Railway (SGR) from Dar es Salaam to Dodoma, a 460 km stretch. Kwala Dry Port, located inland about 80km west of Dar es Salaam has also been opened, serving landlocked countries including Rwanda, DRC, Uganda and Malawi and aiming to reduce cargo transit times from several days by road to under 12 hours by rail, with trains carrying up to 10,000 tonnes.

The SGR expansion will comprise 2,561km of electrified standard gauge rail by 2027, connecting Dar es Salaam to Lake Victoria and to Rwanda’s border, also enhancing trade with the DRC and Uganda.

The 2025/26 budget increased railway funding by 29% to TSh 2.28 trillion, supporting electrification and rolling stock acquisition. The Mwanza section, with 14 trains and 249 wagons, is expected to support

1.2 million tonnes of cargo yearly, cutting transport costs by 40% for minerals and crops. Total investment to date exceeds US$10 billion, primarily funded by Chinese loans and development partners like the African Development Bank (AfDB).

Building on the success – and popularity – of the new networks, CCM has included several new plans in their 2025 manifesto.

Completed SGR stages

• Dar es Salaam to Morogoro (300 km): Operational since 2022; electric trains cut travel time to two hours.

• Morogoro to Dodoma (/Makutupora, just outside Dodoma, 200 km): Completed and operational since March 2025; integrates with the full Dar-Dodoma route (total 541 km).

SGR Stages underway:

• Makutupora to Tabora (368 km): 14% complete as of June 2025.

• Tabora to Isaka (165 km): 7% complete; early civil works ongoing.

• Isaka to Mwanza (341 km): 63% complete; freight trials started in June

2025, full operations expected by late 2026.

• Tabora to Kigoma (506 km): 15% complete; US$2.2 billion contract with Chinese firms targets 2026 completion.

• Tanzania-Burundi Extension (Uvinza to Musongati, 282 km): Construction launched in August 2025 under a US$2.15 billion contract with China Railway Engineering Group.

New pledges:

• New northern corridor (Tanga to Musoma via Arusha/Moshi, 1,028 km): Announced January 2025 and included in CCM 2025-2030 manifesto; feasibility studies underway, lacks confirmed financing.

• Southern route (Mtwara to Mbamba Bay via Songea and Ludewa, ~500 km): Conceptual stage to serve mineral-rich areas like Liganga-Mchuchuma; no financing secured.

• Broader regional links (eg. to Rwanda/DRC) depend on Burundi completion; AfDB has pledged US$3.05 billion overall but gaps remain for extensions.

• Urban / commuter rail networks for Dar es Salaam and Dodoma: included in CCM manifesto.

Ongoing Air Tanzania plans

The CCM manifesto also includes further expansion plans for Air Tanzania. This includes the acquisition of 10 new wide-body aircraft (eg. Boeing 787 Dreamliners) by 2028, funded through public-private partnerships and loans from development banks like the African Development Bank. This builds on recent deliveries of three Boeing 787-8s in 2024.

CCM also pledged to establish a dedicated aviation fund (TSh 500 billion initial allocation) for ATC’s restructuring, including debt relief and performance-based incentives. This also includes improving on-time performance from 65% to 90% via digital booking systems and staff training for 1,000 employees.

ENERGY & MINERALS

by Ben Taylor

Fifth oil and gas licensing round delayed

Tanzania’s Petroleum Upstream Regulatory Authority (PURA) first announced the fifth oil and gas licensing round in February 2025, targeting an opening on March 5 with 26 blocks (23 offshore in the Indian Ocean and three in Lake Tanganyika). This was then deferred to May to maximise investor visibility, aligning with events like the Africa Energies Summit in London on May 13. Pre-launch promotions emphasised the blocks’ potential, backed by over 57 trillion cubic feet of known gas reserves and extensive seismic data (132,000 km²), positioning it as the first major bidding process in over a decade.

However, updates through mid-2025 consistently described it as “poised to launch” or “preparing to offer” opportunities, without crossing into active status. By June and July, industry analysts still framed it as an upcoming event tied to broader natural gas expansion goals.

At the time of writing, the official licensing round website (tanzanialicensinground.com) states that PURA “hopes to make a pre-announcement soon” on the fifth offshore round, with full guidelines, data packages, and deadlines still pending as of late September. No bid submissions have been solicited or received, and requirements for technical/financial proposals remain outlined but not activated.

In a meeting at Africa Oil Week in Accra (late September), PURA Director General Victor Bujuba invited Chevron to participate, explicitly noting “plans to launch a bidding round” for the blocks – indicating it’s not yet live.

No official explanation for the hold-up has been detailed, but contextual factors include aligning with LNG negotiations and ensuring investor reassurance under President Samia Suluhu Hassan’s administration. Global energy market volatility and the need for streamlined processes may also play a role. Analysts remain optimistic, viewing it as a “very important moment” for Tanzania’s energy future, potentially unlocking upstream investments and bolstering exports.

LNG negotiations remain stalled

The lengthy negotiations for the proposed $42 billion onshore liquefied natural gas (LNG) plant in Lindi, Tanzania, remain in advanced but unresolved stages. The project, led by a consortium including Equinor (35% stake), Shell (25%), ExxonMobil (20%), and partners like TotalEnergies and Pavilion Energy, aims to process up to 25 million tonnes of LNG annually from offshore gas fields such as Likomba, Lavani, and Mtwara. The core sticking points – local content requirements, tax incentives, and domestic participation – persist, delaying the Host Government Agreement (HGA) and final investment decision (FID).

Government officials, including President Samia Suluhu Hassan and Energy Minister Doto Biteko (also Deputy Prime Minister), continue to describe talks as “nearing completion,” with an FID targeted for late 2025, potentially enabling construction to start in 2026 and first exports by 2032. However, no binding agreements have been publicly confirmed, and the process appears intertwined with Tanzania’s October 28 general election, where project momentum is being leveraged for political support.

In January, investors had expressed confidence in wrapping up talks “early this year,” citing agreement on key HGA elements from prior framework deals (signed in 2022). This built on a 2023 preliminary HGA but addressed outstanding issues like profit-sharing.

Around April and May, Minister Biteko acknowledged delays due to local content disputes but pledged resolution of three core issues (taxes, participation, incentives) for a 2025 signing. By May, the government reported “significant progress,” aligning with a broader push for gas monetisation amid global LNG demand.

A tantalising near-breakthrough came in July, when officials announced the HGA could finalise “within two weeks” (i.e. by early August), following Attorney General consultations on revisions. Mr Biteko attributed this to President Samia’s direct involvement, positioning it as a pathway to FID by year-end. Industry analysts viewed this as a pivotal shift, potentially unlocking $5-7 billion in initial investments.

However, no follow-up confirmation emerged. August passed without announcements, and Global Energy Monitor’s June assessment noted ongoing delays from financial agreement tweaks. This pattern echoes historical stalls under previous administrations, where investor concerns over resource nationalism halted progress.

Recent updates have clustered around President Samia’s southern campaign tour (September 25-28), reiterate “nearing take-off” without new milestones. In Lindi rallies, she described negotiations as “sensitive and costly” after two years, vowing immediate implementation post-signing if re-elected, and highlighting a new LNG training college as a local benefit. Prime Minister Kassim Majaliwa echoed this, framing the project as a CCM triumph after 12+ years of delays. The ruling party’s manifesto also “reignites” the initiative, promising economic transformation.

Critically, these statements are all aspirational, with nothing to indicate meaningful breakthroughs. Analysts suggest that the election is inflating rhetoric, with real progress likely deferred until after the elections.

Key hurdles include balancing investor returns (amid volatile LNG prices) with Tanzania’s local content mandates. If resolved, the plant could add an estimated 10% to GDP and create 8,000 jobs, per government estimates. Yet, without HGA closure soon, slippage to 2026 – or beyond – is probable.

Gold: refining and expansion

Gold mining, Tanzania’s extractive cornerstone, reported robust growth. The sector earned USD$700 million in the first half of 2025, fuelled by higher output and prices. In July, the government mandated large-scale miners to refine and trade at least 20% of output locally, aiming to build national reserves – the Bank of Tanzania acquired 4.8 tonnes by May.

Major projects progressed: Perseus Mining’s $700 million Nyanzaga gold project, greenlit in April, advanced construction in May, marking Tanzania’s first major gold development in 17 years and promising 220,000 ounces annually. Lake Victoria Gold secured a free carried interest agreement with the government in September, easing fiscal hurdles for its operations. Infrastructure bolstered output; Hitachi Energy connected the Geita gold mine to the national grid in late September, enhancing efficiency at one of Africa’s largest operations.

Helium and critical minerals

Helium extraction has emerged as a bright spot in Tanzania’s extractives sector. Helium One Global advanced its Southern Rukwa project, finalising license terms in June and securing equipment for well development. An independent report in late June validated reserves, with pilot plant commissioning targeted for December 2025. Neighbouring Noble Helium upgraded its North Rukwa resource estimate by 28.5% in July, boosting prospective volumes and drawing investor interest amid global helium shortages.

Base metals and other minerals gained traction. Lifezone Metals closed a $60 million bridge loan for the Kabanga nickel project in September, targeting first production in 2025 and positioning Tanzania as a key supplier for EV batteries. A July-August report highlighted Tanzania’s “bold copper leap,” with innovations to process low-grade ore into high-purity concentrates locally. East Africa Metals updated its Magambazi gold-tantalum project in August, partnering for development and license renewal. August’s minerals value-addition report identified 14 opportunities across gold, graphite, copper, and fertilizers, worth billions. Uranium extraction preparations advanced in July, with 139 million tonnes of deposits promising a 22-year mine life. Rising prices for base metals in 2025 amplified these prospects.

HEALTH

by Ben Taylor

Tanzania pushes for medical tourism leadership

In late September 2025, Tanzania launched a comprehensive strategy to position itself as Africa’s leading medical tourism destination, building on recent infrastructure investments and policy reforms. This initiative aims to capitalise on the country’s growing healthcare capabilities and natural attractions to attract high-value international patients. The plan emphasises upgrading facilities, fostering public-private partnerships, and enhancing specialist services, with an eye on generating substantial foreign exchange – medical visitations already yielded a reported TSh 166.5 billion (approximately US$64 million) in the 2024/2025 financial year.

Central to the reforms is the Benjamin Mkapa Specialised Hospital in Dar es Salaam, which exemplifies the upgrades: state-of-the-art equipment, expanded oncology and cardiology units, and a cadre of internationally trained specialists. The government has allocated funds for similar enhancements at regional hospitals, including Zanzibar’s Mnazi Mmoja facility, which is undergoing a major overhaul to include advanced diagnostics and wellness retreats blending medical care with tourism. These efforts align with broader goals to reduce outbound medical travel – Tanzanians currently spend over US$200 million annually abroad – while drawing patients from East Africa, the Middle East, and Europe for cost-effective procedures like orthopaedics and fertility treatments.

International collaborations are key: partnerships with Indian and Turkish firms will introduce telemedicine hubs and training programmes, targeting a 20% annual growth in medical tourists by 2030. Health Minister Ummy Mwalimu highlighted the potential during the launch, noting that combining world-class care with Tanzania’s safari heritage could create 10,000 jobs and boost GDP by 1-2%.

Challenges remain, including regulatory harmonisation and quality accreditation, but this strategic pivot has much potential. It not only addresses domestic healthcare gaps but positions Tanzania as a regional healer, leveraging its relative stability and affordability in a global market projected to reach US$200 billion by 2030.

Artificial Intelligence in healthcare delivery

On 10 September 2025, Tanzania announced pioneering initiatives to integrate artificial intelligence (AI) into its healthcare system, spotlighted at the 26th Medexpo Africa trade exhibition in Dar es Salaam. Themed “Digital Solutions for Healthcare Transformation,” the event reportedly gathered over 300 exhibitors to showcase AI’s role in diagnostics, efficiency, and patient outcomes. This would mark a major leap for a sector where only an estimated 40% of facilities had digital records pre-2025, aiming to bridge urban-rural divides through tools like predictive analytics and remote monitoring.

Key components include deploying AI-powered imaging software in 50 public hospitals for faster tuberculosis and cancer detection, reducing diagnostic times by up to 70%. Partnerships with IBM and local startup AfyaTech will pilot chatbots for maternal health consultations in Swahili, targeting 5 million rural users by 2027. The US$10 million seed funding, drawn from the national health budget and donor support, also funds training for 2,000 clinicians in AI ethics and data management.

Experts at Medexpo, including WHO representatives, praised the move as “revolutionary” for resource-limited settings, where AI could cut administrative burdens by 40% and improve outbreak responses, as seen in COVID-19 simulations. President Hassan, addressing the forum virtually, linked it to Vision 2050’s digital economy goals, envisioning AI-driven telemedicine to achieve 90% health coverage. Hurdles like data privacy and infrastructure (such as limited internet accessibility) persist, but pilot successes in Arusha (e.g. AI triage in emergency wards) signal promise. By embedding AI, Tanzania is not just modernising healthcare but fostering innovation hubs, potentially exporting solutions to neighbouring nations and positioning itself as Africa’s AI health pioneer.

Mpox outbreak

Tanzania is experiencing a notable outbreak of mpox (formerly monkeypox, or MPV), which began in March 2025. Tanzania confirmed its first two cases on March 10, 2025, in Dar es Salaam, both clade Ib (a more transmissible and severe variant driving the African epidemic). By June 22, 2025, the total reached 64 confirmed cases with no deaths. This rose to 111 cases by July 31, 2025, still with zero fatalities, indicating community transmission primarily among adults via close contact.

The outbreak aligns with the broader African mpox emergency, declared a continental concern by Africa Centres for Disease Control (CDC) in September 2025, though global cases have declined 52% since peaks in May-June elsewhere.

Response efforts include vaccination drives (prioritising high-risk groups), contact tracing, and public awareness campaigns by the Ministry of Health and WHO. As of September 2025, mpox remains a Public Health Emergency of Continental Security according to the Africa CDC, with Tanzania’s cases contributing to over 40,000 reported across Africa this year.

Mpox is a viral zoonotic disease caused by the monkeypox virus that typically presents with symptoms like fever, rash, swollen lymph nodes, and muscle aches. It spreads mainly through close physical contact, contaminated materials, or respiratory droplets during prolonged faceto-face exposure.