by Ben Taylor

Pro-business moves by President Hassan

President Samia Suluhu Hassan’s business-friendly outlook is sending positive signals across the globe, with Moody’s Investors Service changing Tanzania’s outlook from stable to positive.

“The outlook change to positive reflects Moody’s view that political risks have lessened under the government’s new approach to promoting economic development and engagement with the international community,” Moody’s says in its latest change on Tanzania’s rating which was published in October.

Ratings such as those for Moody’s are used by investors globally in deciding on where and why they should invest their money in any particular economy.

President Hassan took over at a time when relations between the government and some investors were somewhat uneasy. The sentiment then was that the country was excessively regulating foreign investors, and that Tanzania’s business climate had abruptly become unpredictable.

As a result, despite promoting industrialisation, a report by the United Nations Conference on Trade and Development (UNCTAD) found that inflows of foreign direct investment (FDI) decreased by 24% between 2015 and 2017.

Later, relations between the government and the International Monetary Fund (IMF) soured when the latter criticised the former for its unpredictable economic policies and unreliable statistics. An IMF report in 2019 warned Tanzania of unpredictable and interventionist policies that worsen the investment climate and could lead to meagre [or even negative] growth, was blocked from being published in the country.

But almost 18 months since the change of guard at State House, Moody’s said the government’s efforts to improve the business and investment climate and attract FDI, most notably in the mining and hydrocarbon industries, offers the prospect for higher potential growth and improving international competitiveness. “Tanzania’s re-engagement with the IMF also has the potential to support higher government revenue generation capacity and unlock greater concessional financing from development partners, supporting debt affordability and increased social spending,” Moody’s said. “Initial steps to improve the business and investment climate include relaxing regulations for foreign work permits, streamlining VAT refunds, and tabling legislation that supports local businesses,” Moody’s noted.

Government officials and some analysts say the government has indeed managed to effectively tell the world that Tanzania was open for investments and that its policies were predictable. “This change is a clear indication that the government’s efforts to create an enabling business environment were being noticed….This will instil confidence to investors that their money will be safe when they invest in Tanzania,” said the Deputy Minister for Investment, Industry and Trade, Mr Exaud Kigahe.

He said the government will keep on creating a friendly-business and investment climate to convince investors that investing in Tanzania could make them be sure of their tomorrow.

Dr Daud Ndaki, an economist from Mzumbe University, echoed this view, noting that the sixth phase government has achieved a remarkable milestone in building investors’ confidence. “This is a positive development. With this positive outlook, we are likely to attract more investors,” he said.

Separately, World Bank Vice-President Victoria Kwakwa praised President Hassan’s “economic miracle,” where key macro indicators showed a strong post Covid-19 position compared to many countries.

Indeed, growth data showed a healthy 5.4% annualised growth rate early in 2022, ahead of earlier projections. The Bank of Tanzania said money supply and private sector credit growth continued to rise swiftly, with the trend being attributed to monetary and fiscal policy accommodation, an improved business environment and recovery of private sector activities from the effects of Covid-19.

Private sector credit growth improved significantly in July and August, reaching around 20%, compared with the projection of 10.7% for 2022/23.

Further, Tanzania appears to have dodged the worst inflationary impacts of the war in Ukraine. Official estimates saw inflation reach 4.6% in August 2022, well below the double-digit figures seen in many countries, and below Tanzania’s own upper-range ceiling of 5%.

Economist and business analyst, Dr Donath Olomi, said there is positive change in perception towards investment and the business environment in Tanzania, which has been influenced by President Samia Suluhu Hassan’s government. “The economic potential has yet to be fulfilled, but we have come far, and there is this confidence as far as doing business in Tanzania is concerned. Trust has recovered, and the trajectory is good,” he said.

Census data published

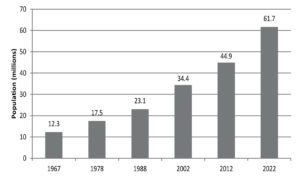

November 2022 saw the publication of the first findings from the 2022 national Population and Housing Census. The main headlines were drawn by the overall total population figure of 61.7 million, up by more than a third from 44.9 million in 2012, representing an annual growth rate of 3.2% since the previous census.

The population of Dar es Salaam has risen a little more slowly over the same period, from 4.4 million in 2012 to 5.4 million in 2022, an annual growth rate of 2.1%. Mwanza meanwhile has grown from 2.8 million to 3.7 million, an annual growth rate of 2.9%.

The overall population figure for 2022 is a little lower than the United Nations Population Division had projected (63.6 million at the end of 2021). Nevertheless, the annual growth rate over the past ten years is considerably higher than had been the case in the previous decade (3.2%, up from 2.7%).

In launching the initial report, President Samia Suluhu Hassan said it was estimated that by 2025 Tanzania will be home to 68 million people and that by 2050 there will be 151 million in the country.

Commenting on the figures, some economists said that rapid population growth makes it more difficult for low-income and lower-middleincome countries like Tanzania to afford the increase in public expenditures on a per capita basis. This, they say, makes it increasingly difficult to eradicate poverty, end hunger and malnutrition, and ensure universal access to health care, education, water and other essential services.

Dr Wilhelm Ngasamiaku, an economist from the University of Dar es Salaam, said it will be important for the economic strategies of the country to take into account the age structure of the population. “In previous census for example, we have seen that people below 18 years account for the majority of the population. This means as a country, you must invest more on social services as demand for health and education will increase,” he said. “But if the majority is in the working age group, 15-59 years, it means we are going to need to re-strategise economically to make sure we create more decent job opportunities,” added Dr Ngasamiaku.

Others say a large population translates into more workers and more consumers who make a good market for locally-produced products for the general good of the economy.

Dr Lutengano Mwinuka, an agricultural trade economist from the University of Dodoma (UDOM), said the population growth provides an opportunity by providing a bigger pool of human capital. “For instance, in agriculture we have a lot of unutilised land across the country. From the census data we can identify the size of the working age group and skills composition and thus we can appropriately develop economic development strategies,” he said.

The initial census data released in November does not include the age profile of the population. This data is expected to be released in 2023.