by Valerie Leach

Poverty Reduction

Much of the news about the economy and business suggests fast-moving new developments. Some of them, notably prospects for gas, are reported elsewhere in this journal. Nonetheless, the Tanzanian economy is still characterised as a basic agricultural one, where rural households continue to live in poverty.

In a recent survey of opinions about the challenges they face, Tanzanians said that poverty, health and education remain the biggest challenges, with 63% reporting poverty to be the biggest challenge (up from 49% in 2012). (Twaweza: “Tanzania towards 2015: Citizen Preferences,” Nov 2014).

The recently released report of the 2011/12 Household Budget Survey by the National Bureau of Statistics shows that one third of the rural population live below the poverty line. (NBS, Household Budget Survey, Main Report, October 2014)

Food Poverty

Rural 13.7 (2007) 11.3 (2011/12)

Dar es Salaam 3.2 (2007) 1.0 (2011/12)

Other Urban 8.9 (2007) 8.7 (2011/12)

Tanzania Mainland 11.8 (2007) 9.7 (2011/12)

Basic Needs Poverty

Rural 39.4 (2007) 33.3 (2011/12)

Dar es Salaam 14.1 (2007) 4.1 (2011/12)

Other Urban 22.7 (2007) 21.7 (2011/12)

Tanzania Mainland 34.4 (2007) 28.2 (2011/12)

Percentage of Population Living in Poverty, Tanzania Mainland, 2007 and 2011/12

Income poverty has been reduced in all parts of the country, but particularly in Dar, and the difference in poverty rates between Dar compared with elsewhere is more dramatic than ever. While the reduction in rural income poverty is modest, living conditions and access to communication improved from 2007 to 2011/12. The percentage of households living in homes with a modern roof has risen from 55% to 68% and those with modern walls from 35% to 46%.

Mobile phones

57% of all households now report having a phone, almost all of them a mobile phone. In rural areas, ownership of a mobile phone increased from 14% in 2007 to 45% 2011/12. Mobile phone ownership reached 88% in Dar and 77% in other urban areas in 2011/12. (NBS, Household Budget Survey, Main Report, October 2014)

Macroeconomic developments

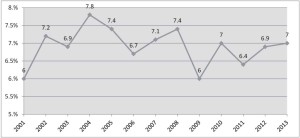

GDP growth rates continue to be strong – 7% in 2013 and estimated by the IMF to be at this same rate in 2014. In October 2014 the annual inflation rate was 5.9%, a fall from 6.6% in September 2014. The NBS has revised the estimates of GDP, increasing the overall estimate of GDP in the base year of 2007 by 28%; and of agriculture GDP by 26%. The revisions result in estimated per capita GDP for 2007 at TSh 699,127 compared with the old estimate of TSh 547,081.

Government revenue and expenditure for fiscal 2013/14 was below target and development expenditure will continue to be adversely affected by the withholding by aid donors of general budget support. Recurrent expenditure amounted to TSh 10,085.1 billion, or 91% of target, while development expenditure was 70% of estimate. The shortfall in development expenditure in 2013/14 was on account of lower disbursement of project funds and shortfall in external non-concessional borrowing.

(Bank of Tanzania, Monthly Review, October 2014, www.bot-tz.org)

An IMF mission to Tanzania in October 2014 concluded that, “Macroeconomic performance has been broadly in line with the program, although new challenges have emerged during the last three months. Economic growth was strong during the first half of 2014 and is expected to remain close to 7% this year… Despite significant revenue shortfalls in the 2013/14 fiscal year compared to the original budget assumption, the fiscal deficit was contained to 4.4% of Gross Domestic Product (GDP)…. However, reflecting continued weaknesses in the ability to control expenditure commitments, this performance coincided with further accumulation of expenditure arrears… Combined with delays in the disbursement of budget financing from development partners, related to the Independent Power Tanzania Limited (IPTL) case, this has been a challenging backdrop for program implementation. .. The expected implementation of VAT reforms in early 2015 should help bolster the revenue base. The mission welcomes the government’s intention to address comprehensively arrears to suppliers and pension funds. (IMF Press Release No. 14/490, October 29, 2014)

Investment and Business

Within the East African Community, Tanzania recorded the highest Foreign Direct Investments (FDI) in 2013, according to the UN Conference on Trade and Development (UNCTAD) World Investment Report 2014. Tanzania’s inflows stood at $1.872 billion followed by Uganda at $1.146 billion. Direct investment from UK was the largest share, at 23% of the total. Recently discovered gas reserves in Tanzania are propelling investor interest. The report also noted that underdeveloped infrastructure has made the country a high-cost location for doing business. (The East African, 27 September 2014)

Tanzania is determined to float a planned $700 million bond in the international market. The government is hoping to capitalise on the investor appetite and stable markets that saw Kenya raise $2 billion in June at fairly affordable terms. Tanzania intends to fund the $1.23 billion Mtwara gas-pipeline project, a $10 billion port at Bagamoyo, new roads, railways and power plants. (The East African, 20 September 2014)

In August, the government announced that a project to construct a major centre to serve as a common entry point for imports from China will start before the end of this year. The centre will be run under a Public Private Partnership (PPP) arrangement with China represented by Yiwu Pan-Africa International Investment Corporation and Tanzania represented by EPZA. (The Citizen, 21 August 2014)

Trade Agreements

In September 2014, Tanzania joined Kenya, Uganda and Rwanda in rolling out the clearance of goods under the East Africa Community Single Customs Territory (SCT).The system seeks to eliminate dumping of goods in countries of transit, thus protecting industries and jobs. (The East African, 13 September 2014)

East Africa and the European Union (EU) have agreed on an Economic Partnership Agreement (EPA). As well as dropping customs duties, the agreement covers free movement of goods and cooperation on customs and taxation. More than half of the imports the EAC has agreed to liberalise are currently duty-free under the EAC Customs Union. Those subject to duty will be liberalised over a period of 25 years, with most of the cuts within 15 years. (The Citizen, 18 October 2014)

Free Trade Area

In December, the heads of state from 26 Eastern and Southern African countries are due to sign an agreement for a free trade area (FTA). Encompassing member states of the East African Community (EAC), Common Market for Eastern and Southern Africa (COMESA) and Southern African Development Community (SADC), the FTA will create a market of over 800 million people. The EAC, which is already a common market, has four member states in COMESA and one member — Tanzania— is in SADC. Ten countries in the region are already members of customs unions. (The Citizen, 19 November 2014)

Rural Communications and Access to Finance

An investment by a Vietnamese firm, Viettel, estimated to be of TSh 1.7trn will connect at least 4,000 villages, about 40% of the country’s total number, to a 3G communication network by 2017. The launch of the project in Coast Regions came after President Kikwete visited the company in Vietnam. The firm has been contracted to connect all district hospitals, police stations, post offices and District Commissioners’ offices, plus three government schools in every district. (The Guardian, 14 November 2014)

Improved telecommunications are expected to help farmers’ access to finance. At a conference in Arusha in November, Vice President Mohamed Gharib Bilal said that poverty cannot be seriously addressed without removing constraints on productivity, including financing of smallholder agriculture and agribusiness. Governor of the Bank of Tanzania Benno Ndulu, said over two-thirds of the working population derived its livelihood from agriculture. Limited access to finance was an impediment to farmers in adopting better technologies. Developments in communication technology are improving the situation; 57% of adults currently have access to formal financial services compared to barely 15% in 2009.

A new study by the Economist Intelligence Unit confirms that Tanzania has the most conducive conditions in sub-Saharan Africa for expanding access to financial services for under-served populations. The use of mobile technology facilitates payment services, including those who have been under-served or unbanked, with the adoption of comprehensive and conducive regulation of e-money and mobile payments.

(The Citizen, 20 and 24 November 2014)