by Alan R. Roe

(This is a summary of a talk to the Britain-Tanzanian Society, November 2014)

In common with Ghana, Kenya, Mozambique, Sierra Leone and Uganda, Tanzania will soon enter the ranks of oil and gas producing countries. Tanzania’s discoveries are mainly off-shore in the Indian Ocean and dominated by gas rather than oil. These discoveries are large, and have excited expectations of greatly improved economic growth and incomes and of a windfall for the Tanzanian budget. The government recognises the need to manage expectations about what all this may mean.

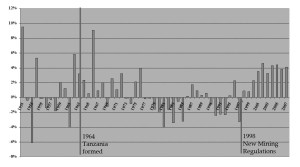

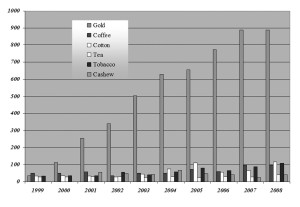

The resurgence of gold and diamond production after 1999 was associated with the first real signs of structural change in the economy since independence. Specifically, the turn of the millennium saw the longest sustained period of per capita income growth (1999-2014) since 1950 (fig.1), Tanzania as one of the top non-oil countries in Africa in terms of the volumes of foreign direct investment (FDI), the rapid rise of gold exports which quickly overtook traditional agriculture exports as a source of foreign exchange earnings (fig. 2), and a significant increase in government revenues from mining to $385 million (7% of all tax revenues) by 2012.

There is considerable controversy in Tanzania over many aspects of mining, as the windfall associated with gold and diamonds has not been managed in a way that might have yielded optimum benefits both to the nation and to the affected communities around Mwanza and Shinyanga. But the mining boom has certainly given the authorities significant experience of the issues associated with managing natural resources wealth.

How will the new gas finds change the situation?

The gas discoveries so far are on a scale far larger than anything ever seen in gold and diamond mining. Early estimates from just one of the 20 or more major companies currently licensed to explore for oil and gas, suggests that FDI from their project alone could top $5 billion in the peak year of construction some 5-6 years from now. This is some five times larger than the maximum annual FDI seen in the years of the gold resurgence.

In the short term (to end-2016) there seems certain to be some significant gains in Tanzania’s capability for electric power generation fuelled by the early stage on-shore gas at Mnazi Bay for which much of the commercial contracting has already been finalised.

In the longer term (after 2021) there are expectations of large gas exports in the form of liquefied natural gas (LNG), with a variety of domestic uses in addition to electric power generation.

Short-term prospects

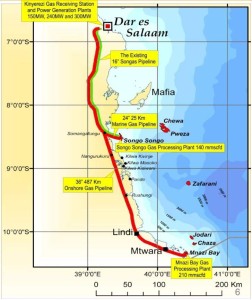

In the past three months Wentworth Resources of Canada, working with Maurel and Prom (a large French company – the operator) and the state-owned Tanzania Petroleum Development Corporation (TPDC), have signed a gas sales agreement (GSA) with the government. This provides for the delivery of up to 80 million cubic feet per day (mmscf/d) to the new Chinese-built Mnazi Bay pipeline to Dar beginning in 2015. This pipeline is much longer than the existing pipeline from Songa Songa which currently delivers the bulk of Tanzania’s existing gas production (fig 3). By 2016 the Wentworth GSA provides for the delivery of up to 130mmscf/d to the new pipeline.

This development is highly significant. First, it will help to justify and partially cover the $1.2 billion costs of the new pipeline, which will have a large capacity (around 750mmscf/d).

Second, the GSA involves a gas selling price at Mtwara of $3 per million cubic feet (mcf), allowing TPDC to sell that gas to Tanesco in Dar at around $5. This should allow Tanesco to generate power at nearer 12 cents/kilowatt hour rather than current cost of around 35 cents using diesel, jet fuel etc. With Tanesco currently selling power at around 16 cents/kwh, the huge government subsidy to Tanesco (estimated at TSh 353 billion in 2013/14) should be significantly reduced.

The new gas will also more than double the volumes of gas currently available for power generation which could contribute significantly to attaining the Tanzanian “Big Results” target of 5 million more people with access to electricity.

Longer-term prospects

The new gas situation will also create new jobs and higher income for some local populations, new investment opportunities such as the integrated cement plant in Mtwara (to supply gas companies), and a welcome albeit small boost to government revenues. In the longer term the scale of the known and likely discoveries will be focused much more on the export of gas – processed into LNG.

The Production Sharing Agreements (PSAs) already signed with government anticipate that at least 5% of total production will be provided to the domestic market, which means up to 95% will be exported. Even a 5% share of a huge volume of gas will provide many opportunities to expand domestic power generation and open up petro-chemical industries such as fertiliser production.

Based on data from three of the concession blocks in the Indian Ocean (Blocks 1, 3 and 4, operated by the UK BG Group in partnership with Ophir Energy and the TPDC), the broad orders of magnitude of the likely impacts in Tanzania from around 2021 onwards are likely to include:

• Between $3 and $5 billion of new export earnings from sales of LNG

to China and other East Asian countries by about the fourth year of production (circa 2025 depending on when final decisions are taken). Tanzania’s total exports in 2012/13 were $5.5 billion.

• An early addition to revenues (taxes, royalties plus production share)

equivalent to just under 3% of GDP – moving towards $2 billion per annum. This compares with Tanzania’s present total grant receipts from aid donors of around 3.3% of GDP and a budget deficit of 5%. It is several times more than the revenues currently received from gold and diamond mining.

• The creation of several thousand new jobs in the 4-5 years of project

construction, falling to several hundred new jobs in the years of regular production.

These potentially transformational orders of magnitudes are based on the likely outputs from only three concession blocks. At least another eight concession blocks in the Indian Ocean have exploration underway – Statoil of Norway, Ophir, Shell and Petrobras of Brazil (see TA 102 for a map of the concessions, and article below by Roger Nellist for information on latest discoveries).

Challenges and dangers

Exploitation of Tanzania’s natural gas presents a wide range of possible threats as well as substantial new opportunities. Several areas of policy need to be very well-managed over the next few years if the Tanzanian people are to obtain a real benefit. The government is well aware of the main issues and its Natural Gas Policy presented in 2013 contains ideas on most of these.

There are still numerous difficult technical problems to solve in extracting gas from the Indian Ocean under 1,400 metres of water and a further 2,000 metres of variable sea bed strata. There is no guarantee that the concessionaires will be able to solve these problems at an acceptable cost.

There is still a question mark over whether the companies will be able justify the huge upstream and mid-stream investments that are required given the (changing) expectations of the global market e.g. the recent large falls in oil prices. One concessionaire alone is anticipating a full investment cost of well over $20 billion.

Can the government and TPDC finance the large infrastructure and investments needed to ensure the delivery and effective usage of the available gas? Who will coordinate the efforts of the different governmental players and prospective investors?

Will the global demand and supply situation remain favourable to exploiting the Tanzanian resources over the very long period (circa 30 years of more) anticipated by the off-shore projects?

A communications strategy is needed immediately to manage expectations in government, in the affected local communities and in the country more generally. The 2013 Gas Policy refers directly to this matter, but the government is handicapped by the fog of ignorance (and rumours) about the true magnitudes and timing of benefits.

Public sector capacity

Much will need to be done to develop skills in both the private and public sectors. Although few direct jobs will be created there are large opportunities for indirect job creation through linkages to the rest of the economy. The problem is that most of the jobs become in the construction phase. To be filled by Tanzanian workers, a large skills training programme needs to start very early – as indeed it has but on a relatively small scale.

Tanzania now has some effective and well qualified civil servants and specialists. But the depth of the skill base is often thin, for example in the areas of contract negotiation, regulation of the sector, contract management, and management of the fiscal regime.

Attention needs to be given to the strengthening of a National Oil and Gas Company (NOC) based on the present TPDC – building its financing, its specific roles, its capacities. The division of roles between government and the NOC has been a source of much difficulty in other countries.

The government needs to exercise caution on the macroeconomic fundamentals to avoid exchange rate appreciation and damage to traditional export activities – the Dutch Disease problem.

Should Tanzania establish a Sovereign Wealth Fund? What stabilization arrangements, if any, should be set up to guard against the future volatility of oil and gas prices and to ensure that other sectors are not left behind?

The emphasis must lie in building human capacity in all sectors with transferable skills from oil and gas. Tanzania is fortunate to discover gas now. They can learn lessons from other countries on the importance of transparency and good governance. Above all, how to protect this unique opportunity from political opportunism and mismanagement, especially with an election in 2015.

Pingback: BTS AGM: Tanzania and Extractives – Another Twist? – November 2014 | Britain Tanzania Society