by David Brewin

“Operation Korosho” (Cashewnuts)

Tanzania’s cashewnut industry began to face serious problems in the last four months of 2018 which is the main harvesting season.

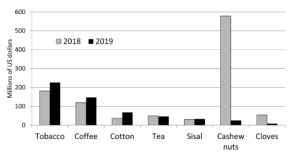

Performance of Tanzania’s traditional exports (source: Tanzania Revenue Authority & Bank of Tanzania)

President Magufuli and the Cashewnut Board of Tanzania (CBT), the regulator and main supplier of inputs, were in dispute. The President decided to remove CBT’s main source of income – a levy on raw cashew exports – and place the funds with the government. The Treasury already owed CBT over TSh 200 billion (US $86m) earned from a levy in previous years which had not been transferred. The CBT proposed a floor price of TSh 1,550 per kilogram, but the farmers considered this too low as it was claimed to be lower than the cost of production.

There was also a dispute over Tanzania’s main and long-standing policy of processing cashews locally rather than exporting them raw. The crucial issue was the low price international buyers were offering for raw nuts, compared with the exceptionally high prices of the previous year, when farmers were paid up to TSh 4,500 per kilo.

As the situation deteriorated, President Magufuli himself went to Mtwara, the centre of the industry, when the main harvesting season began in November and took over personal control of marketing of the crop. He sacked the chairperson of CBT, the entire Cashew Board, the ministers of agriculture and trade and others.

Meanwhile, Tanzanians had become aware of the importance of the crop to the overall economy. In the 2016/17 year cashew nuts brought in a sum in foreign exchange which was greater than Tanzania’s combined earnings from coffee, cotton, tea, cloves and sisal.

Tanzania has about 700,000 hectares of cashew nut farms. According to the Food and Agricultural Organisation of the United Nations (FAO), Nigeria, Guinea-Bissau and Ivory Coast are Africa’s top producers. Tanzania ranks fourth. However, it has only very limited processing facilities, many of which are old and outdated, for processing the crop before it can be marketed worldwide.

After examining the situation on the ground, the President announced that the government would purchase all cashew nut stocks from farmers and insisted that all the collected crop must be moved from primary cooperative unions for storage to government warehouses. It became known as ‘Operation Korosho’.

The government, then under pressure to find foreign buyers before the nuts started to rot, hurriedly signed a memorandum of understanding in early February with a little-known Kenyan – registered firm, Indo Power Solutions Ltd – for the purchase of 100,000 tonnes. These were bought and paid for.

The President then ordered the Agricultural Development Bank to buy the remaining output and sent 75 army trucks to take the nuts into government depots.

The President announced also that the government had handed over the few still functioning cashew nut factories to the Tanzania People’s Defence Forces. But virtually all the factories were found to be needing rehabilitation and so the lack of spare processing capacity forced a change in ‘Operation Korosho’. Instead of looking for markets for processed cashews, the government began to look for markets for raw nuts. However, it is understood that the President’s efforts to sort out the issues were handicapped by the difficulty in identifying which people were eligible to pay, as many farmers had already sold their cashews to local unlicensed traders.

At the end of March 2019, the new Minister of Agriculture announced that the government intended to prosecute at least 780 people for trading in cashew nuts without business licenses.

Although Tanzania produces less than 10% of the world’s total cashew output, it benefits from seasonality by being the biggest producer of the nuts during the October – January harvesting period. Other cashew producers from West Africa usually harvest their crop in February or later.

Private and public sectors

Ever since former President Nyerere in the sixties, influenced by his visits to China, introduced his version of African socialism into the agricultural sector, small scale smallholder farming has remained dominant in Tanzania’s agricultural sector.

When President Jakaya Kikwete took over power he introduced a policy called “Agriculture First” (Kilimo Kwanza) in 2009 which was designed to introduce an element of foreign venture capital investment into the private sector so that there could be the possibility of accelerated production of certain crops. It was a radical policy to continue to support smallholders while promoting, at the same time, large foreign venture capital investment. One of the first projects was supported by a US $47m matching grant fund backed by a World Bank loan of US $70m.

Another project is the Southern Agricultural Growth Corridor of Tanzania (SAGCOT) to support smallholders while promoting foreign venture capital investment. The government insisted that any fixed assets which investors purchase would, at some future date, be transferred to local rural district councils, which would hold the property on behalf of smallholders. SAGCOT is another ambitious public-private partnership, designed to attract global agribusiness where investors develop huge segments of fertile land.

Since coming to power in 2015 the Magufuli government has taken control of fertiliser and seed inspection and bulk procurement and re-empowered cooperative unions in crop purchasing thus undermining private exporters and contract farming. The dramatic takeover of the cashew market by the army on President Magufuli’s orders, have shown the deep commitment of the party and state apparatus to maintaining public control.

Land leases

A very large Swedish investment in an integrated sugar project with an out-grower component failed to take off after years of negotiating with the government over land and water rights.

A second project – a 5,800 hectare rice and maize growing venture, which was expected to be an effective out-grower project – is now up for sale after defaulting on a US $20m loan from the US overseas Private Investment Corporation. This has also not been a success. Eventually, the government decided to ask the World Bank to discontinue the project after prolonged wrangling over how the fund should function with the result that no grants were ever made.

Tanzania is also working on a new policy that will reduce leases of land owned by foreigners from 99 years to 33 years. The policy is likely to be introduced fairly soon. Foreigners will only be allowed to acquire such land after they have registered with the Tanzania Investment Centre.

Tanzania Tea auctions

Tanzania sells between 5,000 and 8,000 tonnes of tea each year through the Mombasa auctions in Kenya. In a bid to cut costs incurred in transporting tea to Mombasa for sale the government is planning to establish an auction in Dar es Salaam. The Tea Board of Tanzania stated that local tea auctioning would reduce transport costs, raise income for farmers and boost business at the Dar es Salaam port.

Higher yielding bananas

The International Institute of Tropical Agriculture, in partnership with Tanzania’s national research centres have developed hybrids of the popular banana called Mchare. These hybrids were bred with disease resistant wild bananas and are high yielding, with high levels of resistance against key pests. The hybrids can increase yields by between 30% and 50%, resistance to at least three major pests and diseases. The diseases that are being addressed by the project are Fusarium Wilt, and Black Leaf Streak disease (Sigatoka), nematodes and banana weevils.