by Ben Taylor

Audits, exchange rates and growth: economics in dispute

A series of arguments flared early in 2019 on economic and related matters, as the state of the national economy became an increasingly significant political battleground.

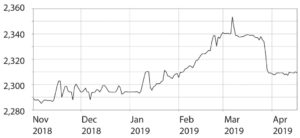

In addition to controversies linked to the annual audits of public sector institutions by the Controller and Auditor General (see Politics section, this issue), arguments arose around exchange rates and GDP growth figures. Tanzania’s leading English-language newspaper, The Citizen, apparently provoked official concern when it reported on a dip in the value of the Tanzanian Shilling. The government suspended the newspaper for 7 days, citing an article published on February 23rd with the front page headline: “Closely monitor fall of Shilling, experts caution.” The offending article reported that the TZS-USD exchange rate had slipped to TSh 2,415 per dollar at some forex bureaus, from 2,300 a week earlier, and stated that the shilling’s value had reached its lowest point for three and a half years. The paper then quoted the responses of Prof Honest Ngowi of Mzumbe University Economics Department and Dr Charles Sokile of Oxford Policy Management, a research and consulting firm, to the situation. Both economists argued that the situation should be monitored, that further depreciation would have economic consequences for Tanzania, and that the government should take steps to protect the Shilling. They pointed to large-scale infrastructure spending, this year’s decline in cashew nut exports and a fall in foreign investment as likely reasons for the Shillings’ reported woes.

A few days later, the government closed at least 50 foreign exchange bureaus in Dar es Salaam, citing concerns that the bureaus had been “flouting the law and regulations governing the business.” It is unclear whether this action was prompted by or linked to The Citizen’s reporting in any way. Indeed, the government carried out a similar clampdown on forex bureaus late in 2018 in Arusha. In both cases, the government argued that many forex bureaus were not properly licensed and that many were engaged in tax evasion.

The Citizen’s suspension attracted the attention of foreign diplomats. In a coordinated response, eight High Commissioners or Ambassadors – including the UK High Commissioner to Tanzania, Sarah Cooke – posted similar statements on Twitter. Their statements noted that their normal morning routine had been affected: “Usually I start my day with a fresh copy of the Citizen. Unfortunately it has been banned for a week. Is this sanction proportionate to the offence purportedly committed?”

It also drew attention from The Economist, which reported that in response to the suspension, “capital is reckoned to have fled to Kenya” and that “foreign-exchange controls are widely said to be imminent”.

The Shilling has since recovered most of its lost ground against the dollar – see chart above. The second economic row to break out focussed on the latest forecasts of the International Monetary Fund’s (IMF) for growth in Tanzania, and their latest report on the state of Tanzania’s economy. The IMF lowered its forecast for Tanzania’s economic growth to 4% this year and 4.2% in 2020 from a previous forecast of just under 7% in each case.

The government forecasts the economy will grow 7.3% in 2019 after an estimated 7.2% expansion last year, helped by investments in public infrastructure.

The IMF’s forecasts were first released on April 9, contained in data tables within their World Economic Outlook but without any accompanying explanatory text or commentary. This commentary was to be found in their 2019 Article IV Consultation Report on the Tanzanian economy, which had been due for publication around the same time. However, a statement posted on the IMF website noted that publication was not yet possible, as “the [Tanzanian] authorities have not consented to publication of the staff report or the related press release.”

The government said that it did not block the IMF report. Minister of Finance and Planning, Philip Mpango, told Parliament that government and the IMF were still discussing the report. “We are in talks with the IMF to sort out the problem before official publication,” he said.

Dr Mpango was responding to a question asked by opposition (Chadema) MP, Frank Mwakajoka: “The government blocked the IMF from publishing its report on the country’s economic status in violation of freedom of expression. What is the government afraid of?”

Even as the Minister gave his response, a leaked copy of the report was already freely available online. The key paragraph is worth quoting in full: “Macroeconomic conditions have remained stable in 2017–18 but there is uncertainty about the pace of economic activity. Headline inflation has been below the central bank’s medium-term target of 5% and the exchange rate has been broadly stable. Official GDP data point to about 7% annual growth, but there are serious weaknesses in the data and other high-frequency indicators point to a more subdued pace of economic activity. For instance, during the 2017/18 fiscal year (July to June), public sector wages, credit to the private sector, and imports fell by 5.3%, 2.9%, and 7.7% in real terms, respectively, while tax revenues grew by 3.1% in real terms.”

The report further distinguished between a “baseline scenario”, in which the current direction of policy is maintained, and an “alternative scenario”. The lower headline growth forecasts relate to the baseline scenario: “a weak business environment and limits to the scale of public investment (from insufficient financing), together with the implementation of projects that may not have high rates of return are likely to constrain annual GDP growth to below the 6.3% average rate recorded between 1998 and 2017.”

The IMF noted that instead, “a more ambitious set of fiscal and market-friendly reforms and appropriate public investments would lead to higher potential growth [of around 6-7% per year]”. This alternative scenario would entail improvements to tax administration and expenditure management, revisions to recently-enacted legislation including the Statistics Act and mining laws, reforms to strengthen governance and lower the cost of doing business.

Finally, the report notes that the Tanzania government was more optimistic about growth prospects: “They considered that their recent estimates of economic growth properly reflect economic activity and envisage that real GDP growth will be in the order of 7-8% per year in the short to medium-term. They believed that their policies were based on robust public investment plans and would be supported by a rationalisation of regulations affecting the business environment.” This government view was also expressed by the Finance Minister when presenting the government Budget Framework for FY2019/2020 to parliament in March. Dr Mpango painted a positive picture about the state of the national economy. Dr Mpango said the government will continue to implement both fiscal and monetary policies to continue sustaining the economy. He said GDP grew by 6.8% during the third quarter of 2018, and that the inflation rate remained “low and stable, at 3% in January this year”. The minister also said extended broad money supply (M3) also grew by an average of 6.6% in 2018 compared with an average of 5.5% in 2017, due to increased lending to private sector.

He said the local currency has continued to remain stable against global major currencies due to implementation of monetary policy, the use of gas to generate electricity, which has reduced fuel imports and improved local production of goods which were previously being imported.

2019/20 Budget

In presenting the 2019/20 budget to parliament, the Finance Minister, Dr Mpango, said the government would focus on four key areas: expanding the country’s industrial base, improving public services, investing in mega-infrastructure, and reforms to strengthen the business and tax environment.

On industry, the Minister noted that “key projects will include construction of a Liquefied Natural Gas (LNG) plant, establishment and development of special economic zones, [establishment] of factories that will add value to agricultural, livestock and fisheries products as well as those that are aimed at adding value to minerals and other natural resources.” On infrastructure, he pointed to construction of the hydroelectric project at Stieglers Gorge on the Rufiji River, improving Air Tanzania Company Limited and building the standard gauge railway line linking Dar es Salaam to Dodoma, Kigoma, Mwanza and Rwanda.

The cost of the plan comes in at TSh 33.1 trillion, up slightly from 32.5 trillion in 2018/19. This increase of 1.8% is the lowest budget increase in recent years, lower than increases seen a year ago (2.5%), in 2017 (7.5%) and 2016, for President Magufuli’s first budget (31%). It reflects concern expressed by politicians and economists that ambitious plans to increase tax revenues in previous years were unrealistic.

This amount (33.1 trillion) will be raised from a combination of taxes (58%) and non-tax revenues (9%), local government taxes (2%), development partners (8%), concessional loans (7%) and non-concessional loans (15%).

Vodacom leadership

In early April, the Chief Executive Officer (CEO) of Vodacom Tanzania, Hisham Hendi, was arrested by Tanzanian authorities, along with eight others. Mr Hendi and the others were questioned by law enforcers allegedly for fraudulent use of network facilities, and some of the group, including Mr Hendi, were subsequently charged. The statement of charged mentioned a “pecuniary loss” to the Tanzania government and the Tanzanian Communication Regulatory Authority (TCRA) amounting to over TSh 11 billion. Other charges included importing, using and installing communication equipment as well as distributing frequency numbers without proper licences.

A week later, Mr Hendi and the others were released as part of a plea-bargain arrangement between Vodacom Tanzania and the Tanzanian authorities. “We pleaded guilty, we had a plea bargain with the Director of Public Prosecutions, and we pleaded guilty,” said Rosalynn Mworia, Vodacom Tanzania’s Director Corporate Affairs. The arrangement included making a TSh 5.28 bn (US $2.29m) payment to the government, and secured the release of all those who had been arrested.

Mr Hendi, an Egyptian citizen, had only been officially in position as CEO for a week before his arrest, though he had been acting CEO for around six months. His appointment came after Ms Sylvia Mulinge, a Kenyan citizen, failed to secure a work permit from the Tanzanian authorities. She had been appointed to succeed Mr Ian Ferrao effectively from June 2018, who had served in the role for three years.

The board of Vodacom Tanzania appointed Jacques Marais as acting managing director.