by Roger Nellist

Uganda-Tanzania oil pipeline agreed

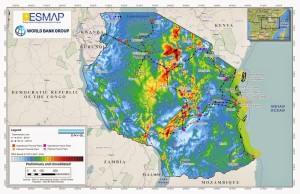

Tanzanian President Magufuli and Ugandan President Museveni have agreed to build an oil pipeline between south western Uganda and Tanga port, allowing the oil discovered in Uganda in recent years to be commercialised and exported via the Indian Ocean. The deal was reached between the two leaders in March at the 17th Ordinary East African Community summit in Arusha. The pipeline will be up to 1,400 km in length and will take an estimated 3 years to build, employing some 15,000 Tanzanians and Ugandans in the construction work. Construction could commence as early as August this year. The total cost is put at US$ 4 billion.

In a separate statement, the Managing Director of the Tanzania Petroleum Development Corporation (TPDC), Dr James Mataragio, announced that the pipe will be 24 inches in diameter and will be able to transport 200,000 barrels of crude oil each day to the port at Tanga. The project will also stimulate the expansion of the port there. Other important details still under discussion include what revenues the Tanzanian Government will earn from the project.

The decision to build this Ugandan oil export pipeline through Tanzania – the so-called ‘southern route’ – hopefully ends a year of uncertainty and speculation. Last year the Ugandan Government initialled a Memorandum with the Kenyan Government, providing for the possibility of the pipeline following a ‘northern route’ through Kenya to Lamu. Mataragio said the southern route has now been chosen partly because of Tanzania’s proven experience of constructing and operating long-distance petroleum pipelines. Concerns over recent terrorist attacks in Kenya are also believed to have influenced the choice.

Unlike in Tanzania, oil discoveries have been made in both Uganda and Kenya over the last few years. In March, Tullow Oil announced it had made a new oil discovery in Kenya, potentially opening up a second oil basin in that country. However, the continuing low price of oil on world markets is inevitably slowing the pace of petroleum exploration around the globe by the international oil companies, which now have significantly reduced revenues from which to fund it.

New Songo Songo facility to process Kiliwani gas

Meanwhile, TPDC announced that the new Songo Songo Island Gas Processing Plant would be commissioned during April, only a couple of months behind the original schedule. Some of the first gas to be processed at the new plant will come from the Kiliwani North-1 (KN-1) production well, operated by Aminex plc and Solo Oil plc. The CEO of Aminex (an independent oil company that has held licences in Tanzania since 2002) announced that testing and other work necessary prior to production of gas from the well had been completed. In a statement, Aminex said: “All KN-1 gas will be sold to the TPDC at the wellhead for an agreed price of approximately US$3.07 per million standard cubic feet and will ultimately be transported by pipeline to Dar es Salaam, where it will be sold into the local Tanzanian market”.

More gas discovered onshore: Ruvu Basin

In March the Minister for Energy and Minerals, Professor Sospeter Muhongo, joined TPDC and representatives of the UAE-based company Dodsal Resources to confirm the discovery of natural gas reserves estimated at 2.17 trillion cubic feet (tcf) in a license block operated by Dodsal in the Ruvu Basin in Coast Region. Gas was encountered through the drilling of the Mambakofi-1 well there last year, since when tests and analysis have been undertaken which have upgraded significantly the initial estimates of gas in the field. The Minister explained that the announcement had been delayed in order to meet the new provisions of the Petroleum Act 2015.

Dodsal has been operating the Ruvu block under the terms of a Production Sharing Agreement signed with TPDC and the Government in 2007. The company now needs to prepare an appraisal and development programme for Government’s approval. Dodsal’s CEO said that “Exploration is still ongoing and we are optimistic of striking more natural gas reserves in the Ruvu Block”. The discovery is especially exciting because of its very close proximity to Dar es Salaam, which will provide a ready domestic market for the gas.

The Ruvu discovery brings Tanzania’s gas reserves offshore and onshore to 57 tcf. It is expected that the development of these very substantial gas reserves will help Tanzania to graduate to middle-income country status by 2025, as stipulated in the Tanzania Development Vision 2025. Minister Muhongo emphasised that “This will be possible when we have adequate and reliable electricity in the economy”.

TANESCO owes Songas

The Government has had to step in to hold discussions with Tanzania’s independent power producer, Songas, to try to prevent it from shutting down because of the large accumulated unpaid debt it is owed by the State electricity utility, TANESCO. The Managing Director of Songas announced that TANESCO owed his company about US$100 million in back payments. He said there is always a risk that Songas would have to close if those arears are not paid; Songas needs the monies to fund further investment in its power supply infrastructure.

TANESCO is the sole client of Songas, so the accumulating arears are a major issue for the firm. It is understood that Songas produces about 25% (180 megawatts) of the national grid’s electricity requirement from the Songo Songo gas field – so any disruption in Songas’ power supply would be serious for Tanzania too.